How to Contrast Medical Insurance Plans and Find the most effective Fit

When it concerns browsing the world of medical insurance plans, the large number of choices available can be overwhelming. Each plan includes its very own set of terms, conditions, and advantages, making it important to very carefully analyze and compare them to establish the very best suitable for your needs. From recognizing the intricacies of policy insurance coverage to assessing company networks and weighing the expenses entailed, there are crucial aspects to take into consideration in this decision-making process. As you begin this trip in the direction of finding the excellent wellness insurance coverage policy, it's essential to come close to the job methodically and with an eager eye for detail to guarantee that you safeguard the most appropriate insurance coverage for your unique situations.

Comprehending Policy Protection

When examining medical insurance plans, comprehending the degree of protection provided is vital for making informed choices about your health care requires. Policy protection lays out the solutions, treatments, and medicines that the insurance plan will certainly spend for, as well as any kind of limitations or exclusions. It is important to very carefully assess this info to guarantee that the plan straightens with your anticipated medical demands.

Protection information typically include inpatient and outpatient treatment, prescription drugs, precautionary services, psychological health and wellness solutions, and maternal treatment. Recognizing the specific coverage for each of these classifications can assist you establish if the plan fulfills your specific or family members's medical care needs - Cobra insurance. Furthermore, some policies may provide additional advantages such as vision and dental protection, alternate therapies, or wellness programs

To assess the adequacy of a policy's coverage, take into consideration variables like deductibles, copayments, coinsurance, and yearly out-of-pocket optimums. By thoroughly comprehending the plan insurance coverage, you can make an educated choice that makes sure monetary protection and accessibility to essential health care services.

Comparing Costs Prices

Recognizing the protection details of health insurance plans is crucial for making notified decisions about your medical care needs, and an essential aspect to take into consideration when contrasting premium costs is the economic investment required for securing these advantages. Premium expenses are the amounts you pay to the insurer in exchange for protection. When contrasting premium expenses, it is essential to look beyond simply the regular monthly costs (medicare supplement). Take into consideration elements like deductibles, copayments, and coinsurance, as these likewise influence the overall quantity you'll invest in health care. A plan with a lower month-to-month premium might have greater out-of-pocket expenses when you require care, while a greater premium plan could use more detailed coverage with reduced out-of-pocket expenses. Reviewing your healthcare needs and monetary situation can aid you select a strategy with premium costs that line up with your spending plan while offering the insurance coverage you need for comfort. Comparing premium prices along with protection information will assist you locate a medical insurance plan that best fits your requirements.

Evaluating copyright Networks

Evaluating provider networks is a critical aspect of picking a medical insurance policy that meets your healthcare needs effectively. A provider network is a checklist of medical professionals, hospitals, and various other doctor that have agreements with a specific insurance company. When reviewing company networks, consider the dimension and range of the network. A larger network typically supplies even more choices and flexibility in picking doctor. A smaller sized network might be a lot more affordable if it consists of the suppliers you like.

Additionally, analyze the network's proximity to your home or office. Having doctor close by can make accessing treatment extra convenient, particularly in emergency situations. It's additionally important to make sure that the professionals and centers you may need are included in the network. Inspect if your existing doctor take part in the network to stay clear of any kind of disruptions in care. Finally, evaluation online provider directories and customer reviews to evaluate the high quality of care supplied within the network. By thoroughly reviewing company networks, you can choose a medical insurance plan that aligns with your medical care preferences and requirements.

Reviewing Deductibles and Copayments

Assessing the financial effects of deductibles and copayments is crucial when picking a wellness insurance plan that straightens with your budget hop over to here plan and medical care needs effectively. Deductibles describe the amount you have to pay out of pocket prior to your insurance protection kicks check my source in, while copayments are repaired quantities you pay for protected services. When examining deductibles, think about both the specific deductible-- the quantity you pay before your insurance provider covers prices-- and the household insurance deductible, which uses when several people are covered under the same plan. Lower deductibles usually indicate higher costs, so weigh your regular monthly budget against potential out-of-pocket prices.

Copayments, on the various other hand, are established amounts you pay for services like doctor sees or prescription drugs. Recognizing the copayment structure for different services can assist you expect and prepare for medical care expenditures. Some plans might have coinsurance as opposed to copayments, where you pay a percent of the complete price of a solution. Contrast plans to find the equilibrium in between costs, deductibles, and copayments that ideal matches your economic scenario and medical care requirements.

Analyzing Fringe Benefits

When discovering medical insurance plans, it is crucial to very carefully examine the extra benefits consisted of beyond the standard coverage (health insurance marketplace). These extra advantages can vary commonly in between insurance coverage strategies and can considerably affect the overall value and suitability of a plan for a person's needs

One secret fringe benefit to take into consideration is prescription useful source drug protection. Some medical insurance policies supply extensive insurance coverage for a wide variety of drugs, while others may have restrictions or call for higher copayments for prescription medications. It is essential for people who depend on prescription drugs to assess this aspect of a policy meticulously.

Various other common extra advantages to review include coverage for precautionary care solutions, psychological health services, maternity care, vision care, and dental care. Depending upon your individual wellness demands and choices, these additional benefits could make a considerable difference in choosing the most appropriate health and wellness insurance coverage plan.

Conclusion

In verdict, contrasting health insurance plans involves understanding protection, comparing prices, assessing service provider networks, reviewing deductibles and copayments, and examining fringe benefits. By carefully assessing these aspects, individuals can discover the most effective suitable for their health care requires. It is very important to consider all elements of a policy before making a choice to make sure extensive insurance coverage and budget-friendly costs.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Raquel Welch Then & Now!

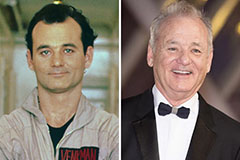

Raquel Welch Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!